When it comes to saving money, fuel tax credits are a valued option for many businesses. Eco-friendly company practices have been an increasingly important source of tax credits for businesses over the last few decades. Alternative fuel sources are not only environmentally friendly; they also help your bottom line.

However, taxes can be an enormous headache when your company has commercial vehicles. Because it’s not just the taxes that mount up; it’s also the record-keeping, the paperwork, and all that time preparing them! Fortunately, fleet management technology provides a way to streamline both your tax status and your fleet’s operations.

What is the Fuel Tax Credit?

The alternative fuel excise tax credit is a financial incentive for businesses to make the switch to alternative fuels for all of their commercial vehicles. You can receive a tax credit calculated per gallon for:

- Natural gas

- P-Series fuel

- Liquefied hydrogen

- Propane gas

- Compressed/liquefied gas from biomass

GGE (gasoline gallon equivalent) or DGE (diesel gallon equivalent) is used to determine how much of a credit you should receive.

How Do I Receive the Fuel Tax Credit?

To increase your bottom line, you always need to be planning for tax time. Running a business that uses commercial transportation requires an immense amount of carefully collected records that not only include how many gallons were used over miles of road but if those roads were private or public.

First, the tax credit is taken against the fleet’s alternative fuel tax liability. Then, the fleet can claim any additional fuel tax liability as a direct payment from the IRS.

Calculating Your Fuel Tax Credit

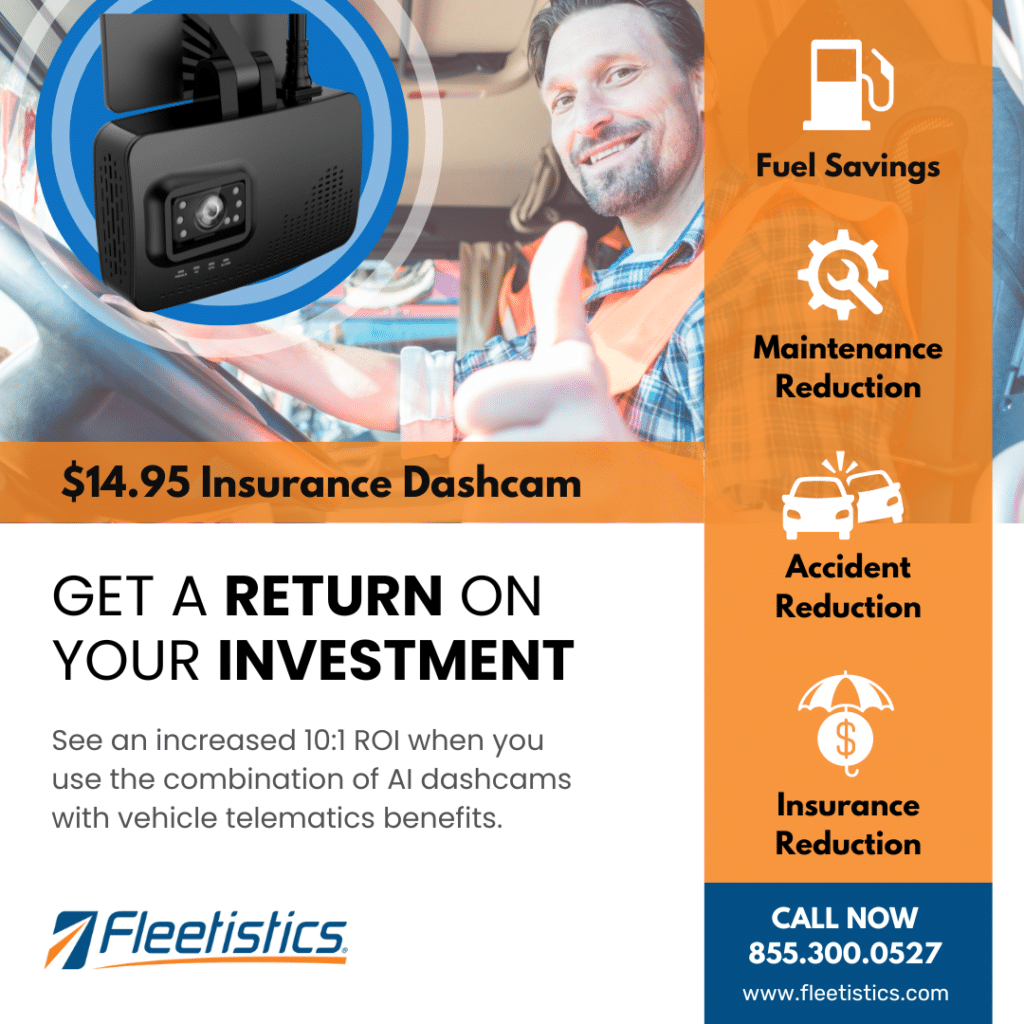

Telematics systems monitor the usage of vehicles and equipment, and consequently the amount of fuel they consume, through the use of sensors. As a result, they can help optimize gasoline tax credit claims while also reducing the amount of time and effort necessary to file claims.

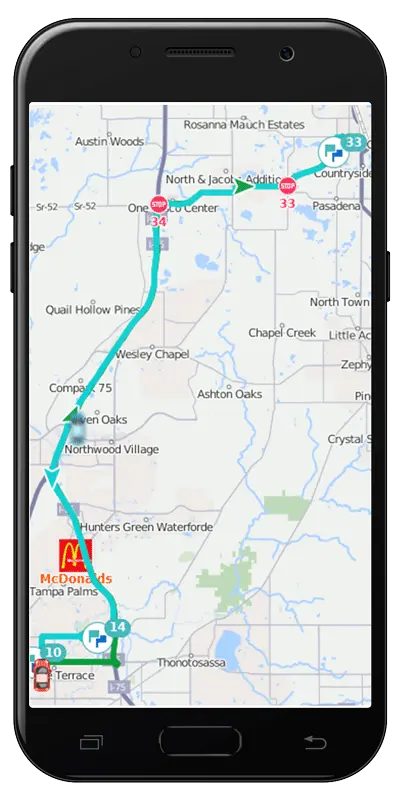

GPS monitoring can also help you to determine how many miles you’ve spent on private roads vs public roads (because only public road mileage should be accounted for).

Without telematics systems installed in your commercial vehicles, calculating your fuel tax credit can be complicated. Your risk of overclaiming and getting in trouble with the IRS is very real. Inferior telematics software has been to blame for overclaiming in the past, but refined telematics systems like Fleetistics fuel tracking will keep you on track!

(Find most of the details in Public Law 114-41 and 26 U.S. Code 4041 and 4081.)

Determining Your Fuel Tax Credit Based on Alternative Fuel Type

According to the US Department of Energy, liquefied natural gas (LNG) is 6.06 pounds per DGE, while propane is 5.75 pounds per GGE and 5.66 pounds per CGE (compressed natural gas). An excise tax of $0.183 per gasoline gallon equivalent (GGE) is imposed by the federal government on propane and compressed natural gas. As of 2022, the tax rate on liquefied natural gas (LNG) is $0.243 per diesel gallon equivalent (DGE).

But legal compliance is automated with fleet management solutions like Fleetistics telematics systems and GPS technology. When claiming fuel tax credits, for example, telematics hardware and software helps by supplying companies with an accurate electronic logbook and work diary.

Fleetistics Can Make Tax Time Simpler

Every three months, all truck drivers in the United States are required to submit a fuel tax report in accordance with the International Fuel Tax Agreement (IFTA). Your drivers are responsible for keeping track of their trucking hours of service.

In addition, they have to save all of their fuel tickets and receipts. Why? Because their records have to coincide with the hours, dates, and addresses that are printed on those receipts!

How much money have you lost through this tedious process and human error?

The precise calculation of gasoline can be made simpler with the help of a fleet management system. By using GPS fleet monitoring and electronic logging records, your business will no longer be a victim to driver and employee mistakes; errors that can result in expensive fines.

There are tax credits available that you can use to cut costs, but they also need to be calculated correctly.

Isn’t it time that you caught a break? Speak with one of our friendly and informative representatives today, and find out if Fleetistics is the right solution for your business!