Service Time Tracking

In order to better appreciate how time monitoring may be applied in business and how it can enhance operations and profitability, it is necessary to first establish what precisely time tracking is.

The goal of time tracking is to keep a record of how time is spent when your employees are working. If an employee is performing their job at a certain location, you can quickly find out an assortment of valuable data by using our telematics system, which not only tracks time but the exact location and so much more.

The knowledge and understanding the system collects is useful for both billing purposes and an in-depth analysis of operations in general.

Time on Site

Time-on-site reporting using telematics is an extremely common practice among companies with a fleet of pickup vehicles, cargo vans, and tow trucks, but many other business models can benefit from this form of time tracking.

If your company provides a service or picks up or drops off products, you’ll need a method to verify whether your employee completed their task and if they did it on time. Proof of services rendered is an invaluable asset to your business, fostering employee accountability and higher customer satisfaction.

Clocking-In Made Easy

The exciting benefit to this way of managing your payroll is freedom! When you use telematics systems, your employees have the freedom to get in the vehicle and start work right away. They do not have to waste time clocking in at a specific place to do their correct time tracking!

Instead of worrying about a paper time sheet or clock-in software, you can save your employees a trip.

Achieve Total Transparency

Total worker visibility is possible with Fleetistics telematics systems. When you monitor how many hours your staff puts in each day, it prevents disputes over compensation, especially legal disputes.

Reduce stress and save money by accurately tracking your employees’ time. From the start of their day, until the end, you can see where your workers are, how long they’ve been there, and where they are going.

Service time tracking doesn’t just assist the business, it also supports employees and protects them. Monitoring activity allows workers and employers a comprehensive view of the employee’s work day and highlights all of their activities to safeguard them from being underpaid, overworked, or falsely accused of misconduct.

Hands-Free Mileage Log

Say goodbye to paper trails, broken laptops, and app glitches. Logging mileage by hand is not only time-consuming, it’s riddled with the possibility of human error.

When your mileage is logged by a telematics system, you don’t have to worry about your employees keeping perfect records. With Fleetistics software, it’s all done for you so that your drivers can focus on what matters most.

Save time and increase productivity with a hands-free mileage log that is proven to put money back in your pocket.

IRS Tax Exemptions

You can save money on tax exemptions by submitting reports that are in compliance with IRS regulations.

Did you know that you can deduct $ 0.575 per mile? Keeping meticulous records is crucial if you want to take advantage of this tax break and save hundreds or even thousands of dollars every year.

When you use the Fleetistics GPS system for tracking, you can breeze through your yearly IRS compliance reports. Saving the mileage data for your vehicles will boost your business by giving you the proof you need to claim the greatest amount of tax exemptions.

Mileage Reimbursement

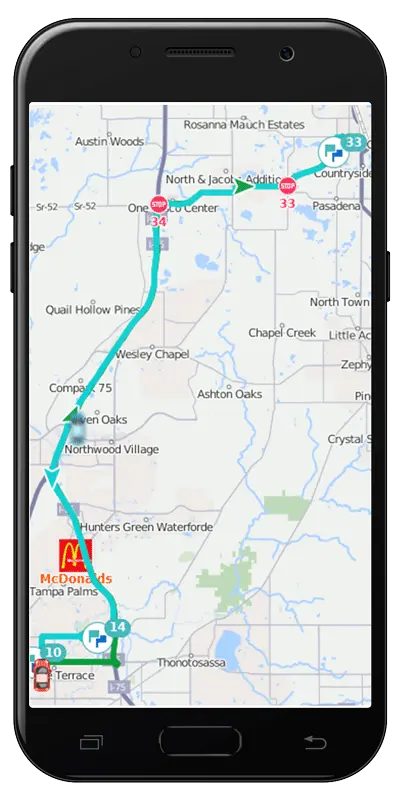

If you reimburse your employee’s fuel costs, a telematics system can make this process easy and simple. Not only will you be able to precisely calculate how far they drove, but you can also see where they are driving.

By using GPS tracking, you can pay your employees for exactly how much fuel they used on the job. Let the data speak for itself based on their mileage and location so that personal travel and work-related travel remain separate.

Fleet management has never been simpler! With our service time tracking solutions, and by tracking location and mileage automatically, reporting business expenses becomes a seamless process that you can count on.

By the way, have you seen part 1 of our blog post series about the benefits of telematics/GPS tracking? Read part 1 now!